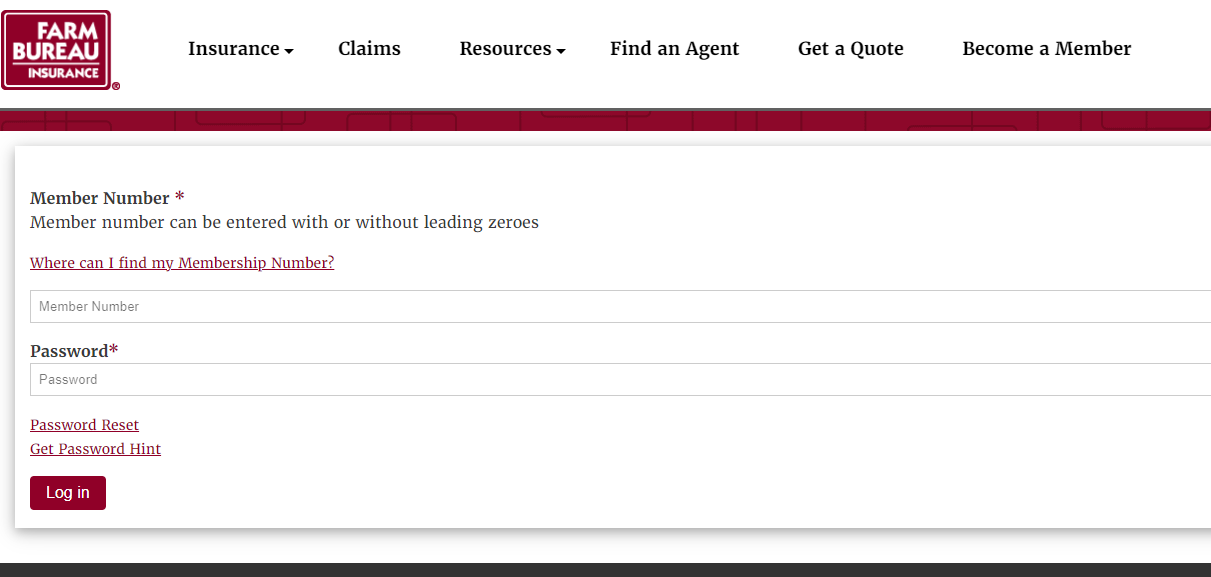

Farm Bureau Insurance Login:

- For the login open the page www.scfbins.com

- As the page opens at the top right click on the ‘My account button.

- In the next screen provide member number, password hit on ‘Log in’ button.

Retrieve Farm Bureau Insurance Login Initials:

- To reset the login details open the page www.scfbins.com

- After the page appears in the login screen hit on the ‘Password reset’ button.

- You have to provide the member number, PIN click on the ‘Verify membership’ button.

Register for Farm Business Insurance Account:

- To register for the account open the webpage www.scfbins.com

- Once the page appears at the login homepage hit on the ‘Reregister’ button.

- In the next screen provide your name, email, zip code, member number, set password, PIN, agree to the terms hit on the ‘Register’ button.

Also Read : How to Access Central Michigan University Account

Farm Bureau Insurance Login :

Their agribusiness roots have molded their way of life and hard-working attitude, which means you’ll get an exceptional client experience. With them, you’re dealt with like an individual, not a strategy. While other insurance agencies may have a one-size-fits-all way to deal with treating clients.

They have confidence in being mindful of your necessities and treating you right. Their cases experts work until the task is finished, and our representatives actually put stock in the responsibility that accompanies a handshake.

Features of Farm Bureau Insurance:

- At Farm Bureau Insurance, their core values join us, regardless of our individual foundations.

- A little gathering of ranchers originally characterized that mission numerous years prior when they set off to frame South Carolina Farm Bureau Mutual Insurance Company

- Homestead Bureau Insurance unflinchingly remains by its obligation to serve all networks and all individuals across their state.

Farm Bureau Insurance Information for Customers:

- All states have monetary duty laws. This implies you should buy a base measure of risk protection or demonstrate that you have saved sufficient cash to pay for the harm you may cause in a mishap.

- Expenses, or the sum you pay for protection, can differ generally. The sort of vehicle you drive, your driving record, your age, your sex, where you live, and the amount you drive normally influence the expense.

- Most mortgage holder’s strategies cover harms to the homes brought about by cyclones or other breeze harm. Our mortgage holder’s strategy covers your home and individual things inside the home. The mortgage holder strategy likewise covers stockpiling structures.

- Most property holder and fire arrangements with expanded inclusion won’t cover flood harms or claims coming about because of rising water. By and large, you would require a flood protection strategy from the National Flood Insurance Plan to have assurance for this kind of misfortune.

- Mortgage holder’s protection gives monetary assurance against debacles. A standard approach protects the actual home and the things you keep in it. In this way, regardless of whether you don’t owe cash on your home, on the off chance that you endure misfortune.

- Mortgage holder’s protection is a bundle strategy. This implies that it covers both harm to your property and your risk or legitimate obligation regarding any wounds and property harm you or your relatives cause to others.

- As well as ensuring your family’s monetary security after you kick the bucket, life coverage may likewise be valuable to you while you are as yet alive. A portion of our disaster protection strategies are intended to allow you to utilize a portion of the cash in your money esteem record to pay costs or to enhance your retirement pay.

- On the off chance that you have some work that offers health care coverage, you could most likely profit by getting your health care coverage through bunch inclusion at your work environment. Nonetheless, on the off chance that you are a low maintenance specialist, independently employed, a project worker, or between occupations.

Farm Bureau Insurance Customer Service:

For more help call on the toll-free number 1-800-799-7500. Or write to P.O. Box 2124, West Columbia, SC 29171.

Reference link: